FAB Wins Digital Bank of the Year

More DetailsUpdates:

Security Center

- Home

- Security Center

FAB Security Center

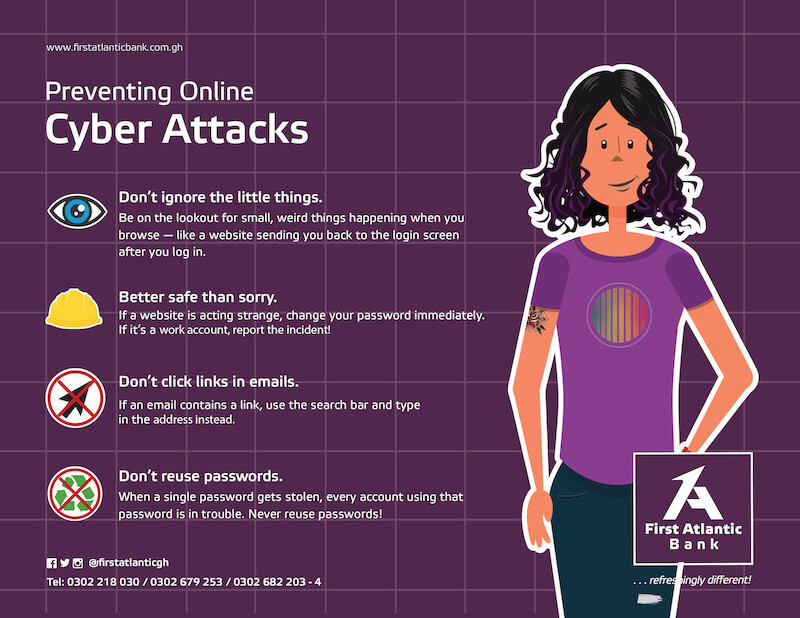

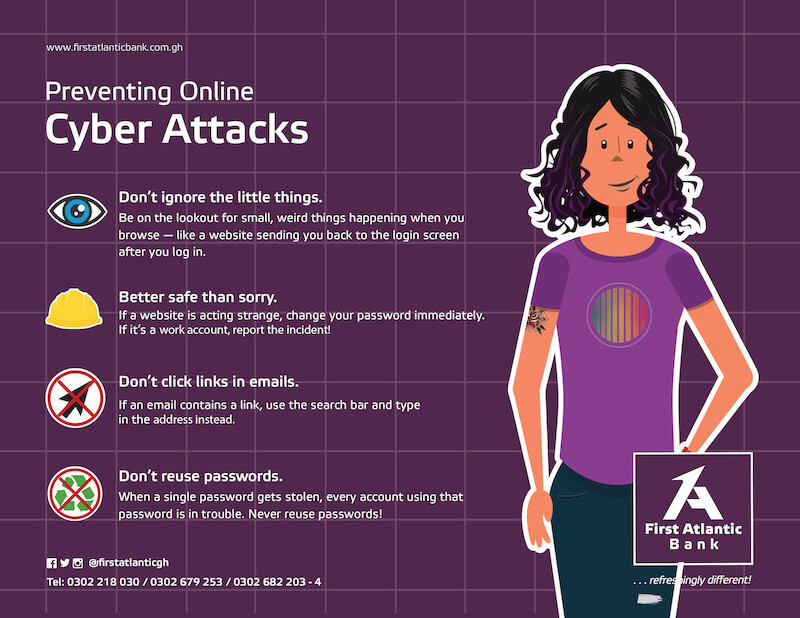

First Atlantic Bank’s top priority is to ensure the safety and confidentiality of your personal information, and we take all necessary precautions to achieve this goal. As technology advances, so do the risks of cybercrime. Protecting your devices and personal information requires ongoing attention and diligence. Take note of these simple security tips to help protect your personal and business accounts.

Policies:

Security Center:

Be mindful of your surroundings, if the machine is tampered with, poorly lit or in a secluded/quiet area, use another ATM.

If anything makes you suspicious while using an ATM, cancel the transaction and remove your card.

When using the ATM or POS device, always cover the keypad while entering your PIN.

Do not enter the PIN if anyone else can see the screen, PIN or transaction amount

Do not share your full card PAN and ATM Card Pin with anyone, including bank staff.

Do not accept help from strangers at the ATM. If you need help, ask a Bank official.

Keep cash withdrawals to a minimum, as well as your daily cash withdrawal limit.

Choose a PIN that’s difficult to guess but easy to remember.

Always take your card and transaction record after completing an ATM transaction, do not leave your receipt behind.

If your card is lost or stolen, or jammed, or somebody interferes with you while using an ATM, you should immediately call Contact Centre on +233 (30) 2679253 to report it and cancel your card.

Subscribe to the bank’s SMS and email alerts to stay updated on your account activity.

Protect your ATM Card and Personal Identification Number (PIN).

Do not keep any written copy of your PIN (Personal Identification Number (PIN) with your card. Memorize it.

When selecting a Card PIN, do not choose numbers and letters that can be easily identified (e.g. birth date, car license plate number, etc.)

Do not disclose your PIN to anyone including Bank staff

Do not use your card to make purchases online on websites that are not secured.

Enroll for Verified by Visa (VbyV) or MasterCard 3D Secure (3DS) to minimize the risks of being defrauded.

FAB will never send you an e-mail asking for confidential information such as debit/credit card numbers, account numbers, passwords, PIN numbers, or social security numbers.

Always cover the ATM keypad when entering your PIN

Always be careful and alert when using an ATM

Never let your card out of sight when making payment

If you suspect your card has been compromised, or call the Contact Centre to cancel the card immediately

Report lost or stolen cards and all instances of suspicious activity to the bank immediately through the contact centre or info@firstatlanticbank.com.gh

If, for any reason, you become suspicious, cancel the transaction and remove your card.

Report scam emails claiming to be from First Atlantic Bank or any of our partner card schemes (MasterCard/VISA) by forwarding the suspicious message to info@firstatlanticbank.com.gh

Lower your card limit where necessary to prevent a criminal from spending or withdrawing more than the determined amount if the card was lost or stolen.

Destroy cancelled or expired cards before disposing of them.

Ensure that your devices have the latest web browser and operating system.

Keep your usernames, access codes, PINs and passwords confidential

Use a unique password for each of your social networking profiles. Ensure it does not match passwords used for banking related activities.

Do not share your personal or account information via email, SMS or phone call

Change your online/mobile banking passwords regularly, especially if you suspect that it has been compromised.

Do not store your username/password in the browser.

Disable the 'AutoComplete' function within your browser.

Do not use public Wi-Fi or devices for your online banking transactions and purchases

Avoid using internet banking on shared computers and public places like cafés and libraries.

Make sure that you perform online shopping and banking transactions from secured websites. The URL must begin with https, the “s” indicates that it is a secured.

Do not reveal the OTP from your security token or SMS to anyone.

Always log out of your online/mobile banking profile and close your browser as soon as you’ve completed your transaction

If you suspect that your online/mobile banking profile has been compromised, contact the bank immediately.

Do not click on links or attachments in unsolicited emails.

Do not respond to any unsolicited emails requesting for personal information, even if they claim to be from First Atlantic Bank.

Signup for sms and email alerts to get notified of activities on your account.

Read and understand privacy policies, so that you know how companies process and store your information.

Download the FAB Mobile Banking App and FlexiPAY App from the Android Google Play Store or Apple App Store only.

Ensure that your mobile device is updated with the latest version of the operating system

Use the latest software on your mobile device.

Use a reputable and updated anti-malware application on your mobile device

Always protect your mobile phone device with a complex password, fingerprint or faceID

Enable the lock screen feature on your mobile phone.

Enable secure wipe feature on your mobile phone to prevent unauthorized access to your information when the mobile phone gets stolen.

Be cautious while using Bluetooth and WiFi in public places as someone may access your confidential data/information

Do not store sensitive information such as ATM PIN, account number, card details, passwords etc., on your mobile phone. Only store in an encrypted or unreadable format.

Always log out of your mobile banking application once you have completed your transaction

Contact the bank to update your bank account details and online/mobile banking profile immediately your phone number changes.

Contact your mobile network operator immediately, if you lose network reception on your mobile phone for no known reason.

Whenever you receive a new cheque book from the Bank, please count the number of leaves in it. If you notice any discrepancy, immediately notify the Bank.

Record all details of cheques issued.

Always keep cheque book at a secure location to prevent unauthorized use

Cheque books must be kept separate from debit and credit cards or any other document that bears your signature to prevent a fraudster from forging your signature.

Do not sign blank cheques. Always fill in the date, the name of the beneficiary and the amount before signing the cheque.

Do not leave signed blank cheques in your cheque book.

In filling out a cheque, write as close as possible to the left-hand margin and ensure there are no gaps in words or numbers. This is to prevent unauthorised additions and/or alterations.

Always cross through any unused space on the cheque.

Shred any unused cheques or cheque books.

To ensure that a cheque is paid into the intended beneficiary's account, the cheque must be marked with the words ‘Not Transferable’ between two transverse lines at the top of the cheque.

Regularly reconcile cheques drawn on your account. If you notice any suspicious transactions or ones you did not initiate, notify the Bank immediately t0 investigate.

Contact the Bank immediately to arrange a Stop Payment. If you wish to cancel a Personal, Business or Bank cheque for any reason.

Immediately report lost, stolen or missing cheques to the nearest FAB branch.

Switch to secured alternative modes of payment such as wire transfers, Internet Banking, Mobile Banking, ATM payments, Debit/credit card payments. Electronic payment is more secure than cheques.

If you have to post a cheque, place it in a non-transparent or dark envelope without any staples/paper clips.

When receiving cheques, be aware of the following:

There should be no variation in the handwriting

The same pen should be used to complete the entire cheque

There should be no visible alterations

There are reports of scammers using phone calls, SMS messages and emails, appearing to be from First Atlantic Bank, to lure customers into giving away sensitive information.

The sender usually asks for information such as your account number, user ID, password, Ghana Card number and ATM Card pin number etc. and making any of the following claims:

Your online account password has been deactivated

Your bank account has been made dormant

Your personal information needs to be updated

You have won some cash.

Please note that First Atlantic Bank will never requests sensitive information from customers over the phone, email, social media or through SMS messages. In the event that a phishing message is received via e-mail, please forward it to info@firstatlanticbank.com.gh

Phishing is a fraudulent attempt where fraudsters send unsolicited emails pretending to be from legitimate sources. The purpose is to lure individuals into giving out personal information that can be used for fraudulent activities.

Phishing has other forms – on phone (vishing) and through text message/sms (smishing).

How to recognise a phishing scam:

Scammers often send out emails claiming to be from First Atlantic Bank, its partners or any other reputable organization.

The content of the email may look genuine with the use of the bank’s logo and similar email signatures to convince you that the email is legitimate.

The email may request for confidential information urgently.

The email may contain unfamiliar email addresses/may be from an unknown sender.

The email may demand for an immediate update or verification of some details by clicking on a link, attachment or icon.

There is usually a sense of urgency, followed by a threat or making reference to your account being suspended if action is not taken immediately.

The email may contain grammatical errors.

Scammers often send out emails claiming to be from First Atlantic Bank, its partners or any other reputable organization.

First Atlantic Bank has a number of security measures in place to protect you, however, your awareness is the key to avoid being a victim of phishing attacks. Below are some helpful tips:

Treat all unsolicited emails, text messages and requests online as suspicious.

Never reply to emails from unknown sources.

Delete spam emails immediately.

Never click on links or attachments from unknown senders. If in doubt, verify if the sender/caller is legitimate

Check the destination of the hyperlinks in the email sent by hovering your mouse cursor over it.

Do not visit our website or internet banking portal through a hyperlink sent via email or text message – always type the URL address in your browser.

Do not give in to any requests for personal details via email, text messages, phone call or on any links within suspicious emails. When in doubt, verify with the nearest bank branch.

First Atlantic Bank will never ask you to reply to an email or to SMS any personal and financial information such as your username, password, credit/debit card number, PIN numbers or any other sensitive information. If you receive such a request, kindly do not respond and alert us immediately by email info@firstatlanticbank.com.gh or call +233 (30) 2679253.

If you wish to report any phishing or fraud attempt relating to First Atlantic Bank, please forward details via email without modifying the contents to info@firstatlanticbank.com.gh. We will investigate the matter and take immediate action.

A scammer is able to perform an illegitimate SIM swap with your mobile network service provider by presenting forged documents belonging to the victim. The scammers get access to your personal details through phishing emails or vishing tactics in order to impersonate the victim and request for a new sim card from the mobile network provider. This gives them total access to your phone calls contacts, text messages, OTPs and other notifications they can use to defraud you.

How to identify Sim SWAP:

Your cellphone suddenly has no signal in a regular network area

You are no longer receiving calls or messages on your cellphone

You don’t receive the OTP you requested, even when trying a second time.

Protect against sim swap:

Do not expose your personal information: protect your bank account and mobile account information also when you are online.

Immediately report to your Mobile Network Operator when you notice that you have no signal and not receiving calls and messages.

If you suspect or have discovered a potential security concern on any First Atlantic Bank product or service, contact us by emailing to info@firstatlanticbank.com.gh and a bank representative will reach out to you.

Please provide the following information in your email:

Name and contact details to discuss the security concern.

A summarized and high-level description of the concern (do not include specific details of your concern until the has established a secure communication channel with you)

You can also call +233 (0)30 268 2203/268 0825 or visit your nearest bank branch.